Beating the Closing Line refers to obtaining better odds than the final pre-event odds. This is also known as ‘beating the Start Price’, or ‘beating the Closing Line Value’ (CLV) in the United States.

Bettors that can find a way to consistently beat the Closing Line are likely to generate winnings over the long-haul. But in practice, that’s a lot more challenging than it seems.

In this article I use my own research & findings to prove that beating the Closing Line gives bettors the maximum chance of success. I also provide several tips for how to beat the Closing Line on a consistent basis.

Article Contents

Why Beating The Closing Line (CLV) Matters

The Closing Line simply refers to the odds at the time an event starts. It’s sometimes referred to as the ‘Starting Price‘, or just ‘SP’.

But how and why is the Closing Line significant? Why would beating it improve the chances of making a profit?

Significance of The Closing Line

The Closing Line is significant because it marks the final pre-event point: when the odds are formed, and the most amount money has been transacted at bookmakers and exchanges before the markets go inplay. At this moment the odds incorporate all the opinions of the public — both retail and professional — from the lead up to the event.

Importantly, it’s hard to find value from the Closing Line because the market participants (bettors of all kinds) have shaped the odds and eliminated obvious inaccuracies. This means that right before an event begins, the odds are the sharpest they’ll ever be.

Using a betting exchange, bettors should expect to break-even, or worse, by regularly taking the Starting Price. Hence why the majority of professional sports traders and value bettors operate earlier on, in pursuit of better odds.

Learn more about how the Starting Price is set for racing.

Betting Above The Closing Line

Given the sharpness of the Closing Line, there’s a simple principle that holds true for all sports and markets:

If you consistently bet at higher odds than the Closing Line (the Betfair Start Price), then what you have found is value, which will succeed in the long-run. This is known as “Beating the Closing Line”.

So if you compare all of the odds you take with the Starting Price, then you’ll have a good idea of how valuable your bets were, regardless whether they have produced a profit or not.

Generally:

- If your betting odds DRIFT (rise) by the start of the event, then you have failed to beat the Closing Line. Your bet doesn’t have value as it goes inplay.

- If your betting odds STEAM (fall) by the start of the event, then you have beaten the Closing Line. Your bet has value as it goes inplay.

Therefore the Closing Line can be used to check whether any selection criteria, betting system, tipster service or other approach is likely to be profitable or not. Furthermore it can help to identify false-positives (losing strategies on a good run), and a false-negatives (winning strategies on a bad run).

The Bigger The Difference, The Better

While consistently beating the Closing Line is highly likely to return positive results, not all bets hold an equal value.

Consider a horse initially backed at odds of 10.0, which subsequently drops to 6.0 before the race begins. This scenario holds greater value compared to a horse whose odds decrease only slightly, say from 10.0 to 9.0. The former represents an ideal “great odds” situation sought after by most bettors. The significant shift in price enhances the value of the bet, which is reflected in the potential cashout amount on a betting exchange or bookmaker that supports cashout.

The key to increasing your overall ROI is to beat the Start Price by the highest margin, as frequently as possible.

How Accurate Is The Closing Line (CLV)?

Of course, the principle behind beating the Closing Line relies entirely on the accuracy of the sports betting markets. Can the markets be relied on? Is this method really full-proof?

While it may seem like a huge leap of faith to novices, it’s well-known among seasoned bettors that the Betfair markets for popular sports — such as UK horse racing, and top-flight football — are very accurate. The markets naturally form a strong “aggregation of diverse opinions”, forming true probabilities for the different outcomes of an event.

Provided certain conditions are met, then the Closing Line on the betting exchange (i.e the Betfair Start Price) is accurate enough to rely on for your analysis — which I’ll prove in the remainder of this article. You can learn more on the efficiency of the betting exchange in my article on the Wisdom of Crowds Theory.

Note that the Pinnacle Closing Line can also be used for sports betting analysis, due to the bookmaker’s sharp odds and low margins. However, I do not recommend using the Closing Line from traditional ‘soft’ bookmakers, due to the large margin incorporated into their odds.

Proof That Beating the Closing Line Produces Positive Results

At this point you may still be unconvinced in the accuracy of the Closing Line and how it can be used as a measure for profitability.

In this section I refer to the results of a large test strategy which ran on the Betfair exchange.

Strategy Details:

- 59,281 Back bets

- Horse Racing only

- All bets placed on the day of the race, at any point up until the ‘off’

- £10 equal stakes on selected horses in the Win market

- Assumes 5% commission was taken by the betting exchange

- Average decimal odds taken: 8.66.

- The sample made a profit.

The separate breakdowns which follow will alleviate any doubts you may have over the importance of beating the Closing Line. I’ve split the results as follows:

- Bets that beat the Closing Line

- Bets that didn’t beat the Closing Line

- Non-movers that remained around the same value as the Closing Line.

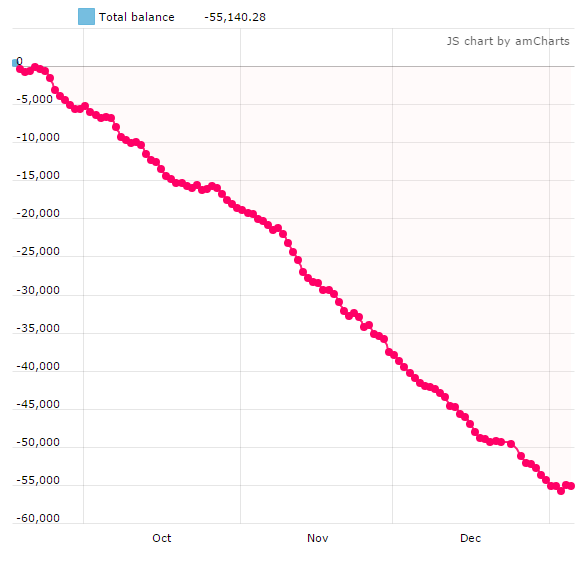

Bets that Beat the Closing Line

The strategy had 31,448 bets that were Backed at greater odds than the Betfair Start price (BSP), which produced a yield (ROI) of +19.62% after commission. This accounted for 53.04% of the total bets placed.

The odds Backed were an average of 13.72% above the SP.

Despite there being many losing bets in this sample, the result is indisputable. The strong positive trend precisely illustrates the importance in beating the Closing Line with odds available before the start of the event.

PnL of all bets in a sample strategy that beat the closing close

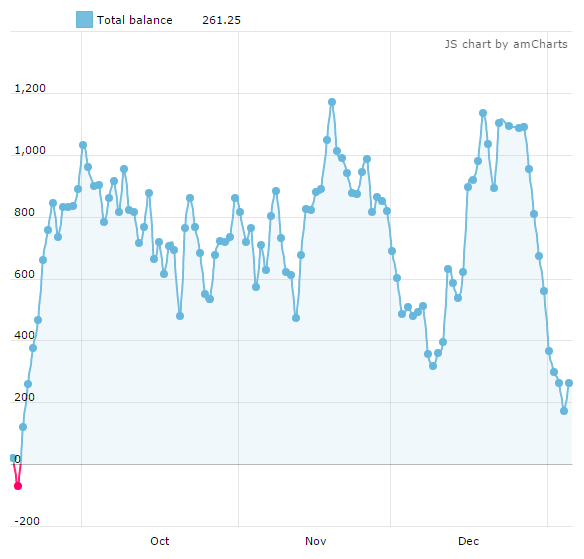

Bets that Didn’t Beat the Closing Line

In this strategy there were 25,693 bets that were Backed at lower odds than the Betfair Start price (BSP), accounting for 43.34% of the total number of bets, producing a negative yield of -22.35% after commission.

The average closing odds were 20.16% above the odds Backed by the strategy.

The strong negative trend (which is seemingly a reflection of the previous graph), underlines how failing to beat the Closing Line loses money over a large sample of bets will lose money.

PnL of All bets in a sample strategy that didn’t beat the Closing Line

Non-movers — Odds At the Same Value as The Closing Line

There were 2,140 non-movers in the strategy, accounting for 3.6% of the total number of bets, producing a yield of 1.09% after commission.

Non-movers belong in a kind of “Purgatory”. The odds haven’t moved significantly enough to be classified as either beating, or failing to beat, the Closing Line. These odds either:

- Didn’t move after Backing them, or

- Moved, but later reverted back to the same odds

In theory, these represent occurrences where the strategy obtained fair value.

As expected, the results lack a consistent trend as shown by a graph that gives no strong indication as to what direction the PnL is heading.

PnL of All bets with odds that remained at the same value by the Closing Line

What Do The Results Mean?

One the most important points to take away is that the betting exchange is efficient. The results of thousands of bets in this strategy are testament to that. It’s no coincidence that the bets that beat the Betfair Starting Price made a huge profit, and those that didn’t made a huge loss.

So the closing line can be used to determine bets that were valuable, and those that weren’t.

In summary these findings, beyond any doubt, illustrate the importance of:

- Maintaining a high percentage of bets with odds that decrease by the start of the event.

- Reducing the percentage of bets with odds that increase by the start of the event.

…but that’s a lot easier said than done!

GodsOfOdds concurs that it’s vitally important to beat the “closing line” for successful betting, and has used simulations to demonstrate the merits of doing so.

Strategy Improvements

The strategy isn’t optimal. I have simply demonstrated how the value of the Start price correlates to how successful the bets were.

The strategy can be improved by applying two rules:

- Neutralise the Risers by trading out of a bets. This means breaking even with a “scratch trade”, or accepting a small loss.

- Preserve the Fallers by holding onto a position till a later point (and cashing out), or simply holding the position without Laying off.

But be aware that prices sometimes Rise initially and then go on to Fall heavily. Other times prices Fall first and then Rise heavily. It’s not always as clear cut as it seems.

So now the big question is: how can you beat the Closing Line?

Approach 1: Use Arb & Value Bet Finders

Following a (theoretically) profitable ‘feed’ of arbs or value bets is, by far, the simplest way to beat the Closing Line.

Both arb and value bet finders provide a stream of odds that typically shorten after being identified. Over a large enough sample, arbs and value bets beat the Closing Line.

It’s worth noting that arbs often occur when the bookmaker was too slow to slash their price. The bookmaker catches up with the ‘sharps‘ shortly after. Hence the bookmaker side of a basic ‘Bookmaker vs Betfair’ arbitrage bet, overall, beats the Closing Line while the exchange side does not.

Value bets from subscription products are capable of finding less ‘obvious’ inaccuracies in the odds than arbitrage bets. These opportunities are eventually eliminated out by bettors snapping up the odds before they drop down to their true price — hence enabling fast punters to beat the Closing Line.

For the best value bet finders, check out my review: Best Value Betting Software

Approach 2: Apply Trading Techniques

I don’t want to trivialise how difficult it is to Beat the Closing Line as a sports trader. After all, finding odds that drop off is what most Betfair traders are looking for!

Sports trading requires an immense amount of practice, discipline and, above all — skill — in order to succeed. Here’s some ways of approaching it.

“Cold” Trading

Cold Trading is the name given to the approach of using only market information, without the support of additional knowledge relating the sports event.

It may come as a surprise to some of you to learn that many of the most successful horse racing traders know very little about race specifics like the form, jockeys, trainers, pedigree, the going — and many don’t even watch the races they bet on. These kinds of “cold” bettors exist in both the financial and sports betting worlds.

Cold Trading lends itself to beating the Closing Line, because it’s all essentially a game of “higher or lower”. The only goal is to bet higher than final odds, which doesn’t rely on having knowledge on the specifics of a sporting event.

An optimal time to enter the market is in the final 30 minutes before a horse race. This is where the late money arrives into the market.

Matched Money: How volume hits the horse racing markets late on before a race

One metric traders use in the final 30 minutes is the Weight Of Money, which helps to estimate the direction the odds will head next. This can be useful for securing a price that’s likely to keep steaming as the ‘off’ approaches.

Be warned though: the odds don’t simply pick a direction and continue going that way — up and down fluctuations are very common.

Identify Human Influences

Humans impact sports betting odds.

It’s in our nature is to form opinions and act on them, no matter how irrational they might be. But when humans get it wrong, it creates value betting opportunities. The most common human factors influencing the horse racing markets are:

- Superstition & Random choice: Horses are chosen for the most peculiar reasons such as the name, colour, or even just a “feeling”. The opinion isn’t necessarily well founded.

- Pre-race Observations: A horse’s equipment or appearance in the parade ring plays a part. Its gait, sweating, or restiveness can influence our confidence. The public observes signs of strength or weakness, as tenuous as they may be.

- Herd Mentality: Odds rise or fall as a result of momentum. Once the market has moved in one direction many bettors jump on the back of it and push the odds further in the same direction.

Finding a way to identify exaggerated market movements and false-alarms is extremely powerful to any sports bettor or trader, and it drastically improves their chances of beating the SP. In particular, traders should look for “herding” — because odds tend to revert back to where they ought to be after they have moved too far in one direction or another during a flurry of activity.

Approach 3: Analyse Past Data

Some successful bettors are known to use past data to develop their own method for beating the Closing Line. This is somewhat the opposite of “Cold” Trading as it relies heavily on knowledge of the sport itself.

If you know the factors that impact the results of sporting events, then you may be in a position to find inaccuracies (and therefore value) in the odds. Value bets, over a large enough sample of bets, are likely to beat the Closing Line and make a profit.

Horse racing is one of the best sports to analyse for past trends.

Basic Statistics

Bettors can identify odds that are likely to decrease by the ‘off’ using basic metrics such as:

- Horse-specific: How does the age, sex, fitness, and weight-over-distance ability compare with the other horses?

- Form: what are the Jockey/Trainer’s strike rates?

- Race type: How are the horses likely to perform on a specific race type based on their track record?

- Weather conditions: How do the horses typically perform under the current weather conditions?

If you’ve identified a high price, then the sooner you strike, the better! The markets will eventually eclipse these opportunities if you don’t act quickly.

Learn more on horse racing selection criteria from my post ‘What Causes Pre-Race Market Movements?‘

Advanced Statistics

Although advanced statistics are often difficult to obtain and/or collect, they can greatly can assist in beating the Closing Line.

For example, a small portion of bettors use pedigree data in order to find an advantage over the market.

The lineage of a horse, as indicated by its pedigree, provides insights into its genetic potential. Over time, it’s been evident that offspring from top-tier sires tend to outshine those from less impressive ones. Therefore, tapping into pedigree information can prove advantageous in spotting opportunities within the betting market. This is particularly true for maiden races or instances where horses are racing on new surfaces, where the majority of bettors may lack substantial historical data to guide their decisions.

Learn more about horse pedigree.

In markets predominantly driven by public news, gossip, or speculation, advanced factors — like a horse’s bloodline — often receive scant attention. Delving into these aspects could significantly enhance the chances of uncovering a competitive edge and outperforming the Closing Line.

You can find horse pedigree data from:

Complications In Using Past Data

There are complications in using statistical methods to Beat the Closing Line:

- You have to be confident that the market has incorrect prices, and not you. The market incorporates so many opinions and diverse points of view that you’re more likely to be in the wrong.

- If your selection method is the same as many other bettors’, then you’re unlikely to have any strong advantage. You need to know something that the others don’t.

- If the odds you calculate are too closely in-line with the odds on the betting exchange, then you may have only achieved a method for compiling odds. This isn’t necessarily going to help find you to beat the Closing Line and make a profit

- A strategy may work for a while, but not forever. Many strategies fail once they become too popular or obvious to competitors.

Hopefully there’s enough information here to help get you started with Beating the Closing Line (CLV), as well as value betting as a whole. Good luck.

- Best Football Tipsters|Top Ranked Soccer Tipster Services 2024 - April 25, 2024

- Best Horse Racing Tipsters |Top 40 Racing Tipster Services 2024 - April 24, 2024

- How To Resolve Disputes With Casinos & Bookmakers (Step-by-Step) - April 23, 2024