Financial betting has transformed how people speculate on markets — offering direct access to stocks, currencies, and commodities without owning them. Yet with that accessibility comes risk: leverage can magnify both profits and losses, and not every platform is transparent about its costs or safeguards.

This guide highlights the UK-regulated providers that genuinely stand out for safety, clarity, and usability. We’ve identified the financial betting platforms that combine solid FCA oversight, fair pricing, and effective risk controls — not just marketing claims. The goal is simple: to help traders find trustworthy, tax-efficient ways to speculate on global markets.

Article Contents

Types of Financial Betting

Financial betting covers several products that let you speculate on markets without owning assets:

- Fixed-odds betting: Simple yes/no outcomes offered by bookmakers, e.g. betting on where BTC will close at month-end. (See: Financial Betting at Bookmakers.)

- Spread betting: Stake-per-point bets on whether a market rises or falls; profits and losses move in proportion.

- CFDs: Regulated contracts that mirror market price changes with leverage; available via trading platforms.

Best Financial Betting Platforms 2026 – Quick Comparison

Before the deeper reviews, this table gives a snapshot of where each UK-regulated platform fits best and what you can expect at a glance.

| Platform | Best For | Product Type | UK Regulator | Demo | Website |

|---|---|---|---|---|---|

| Spreadex | Tax-efficient spread betting | Financial & sports spread betting (+ CFDs) | FCA (UK) | Yes | Spreadex.com → |

| eToro | CFDs + social/copy trading | CFDs & long-only investing | FCA (UK) | Yes | eToro.com → |

| Plus500 | FX & indices CFDs (clean UI) | CFDs only | FCA (UK) | Yes | Plus500.com → |

Note: Fixed-odds “financials” at traditional bookies (e.g., monthly BTC price ranges) are bets, not leveraged trading—see the section below for where those fit.

1. Spreadex – For Financial Spread Betting

Spreadex combines financial and sports spread betting in one FCA-regulated platform, giving UK users a professional yet approachable way to speculate on global markets. It’s one of the few firms offering tax-free spread betting profits alongside optional CFD access, all within a single, straightforward account.

The platform layout is clean, execution is reliable, and the interface suits both cautious beginners and experienced traders. New users can explore live pricing and order management safely using a free demo account before risking real funds.

Key Features

- FCA-regulated spread betting and CFDs in one account

- Tax-free profits on spread bets for UK residents

- Wide market range including indices, FX, shares, and commodities

- Sports spread betting available under the same login

- Practice mode with real-time pricing and trade simulation

- Competitive spreads and transparent margin tracking

| UK Regulation | Financial Conduct Authority (FCA) – United Kingdom |

| Products | Financial and sports spread betting, optional CFDs |

| Market Range | Indices, FX, shares, commodities |

| Typical Leverage | Up to 1:30 (retail limits) |

| Demo / Practice | Yes |

| Tax Snapshot (UK) | Spread-bet profits generally CGT-free; losses not offsettable |

| Website | Spreadex.com → |

Verdict: Tax-efficient, FCA-regulated, and beginner-friendly — a clear choice for UK traders who want spread betting and CFDs under one roof.

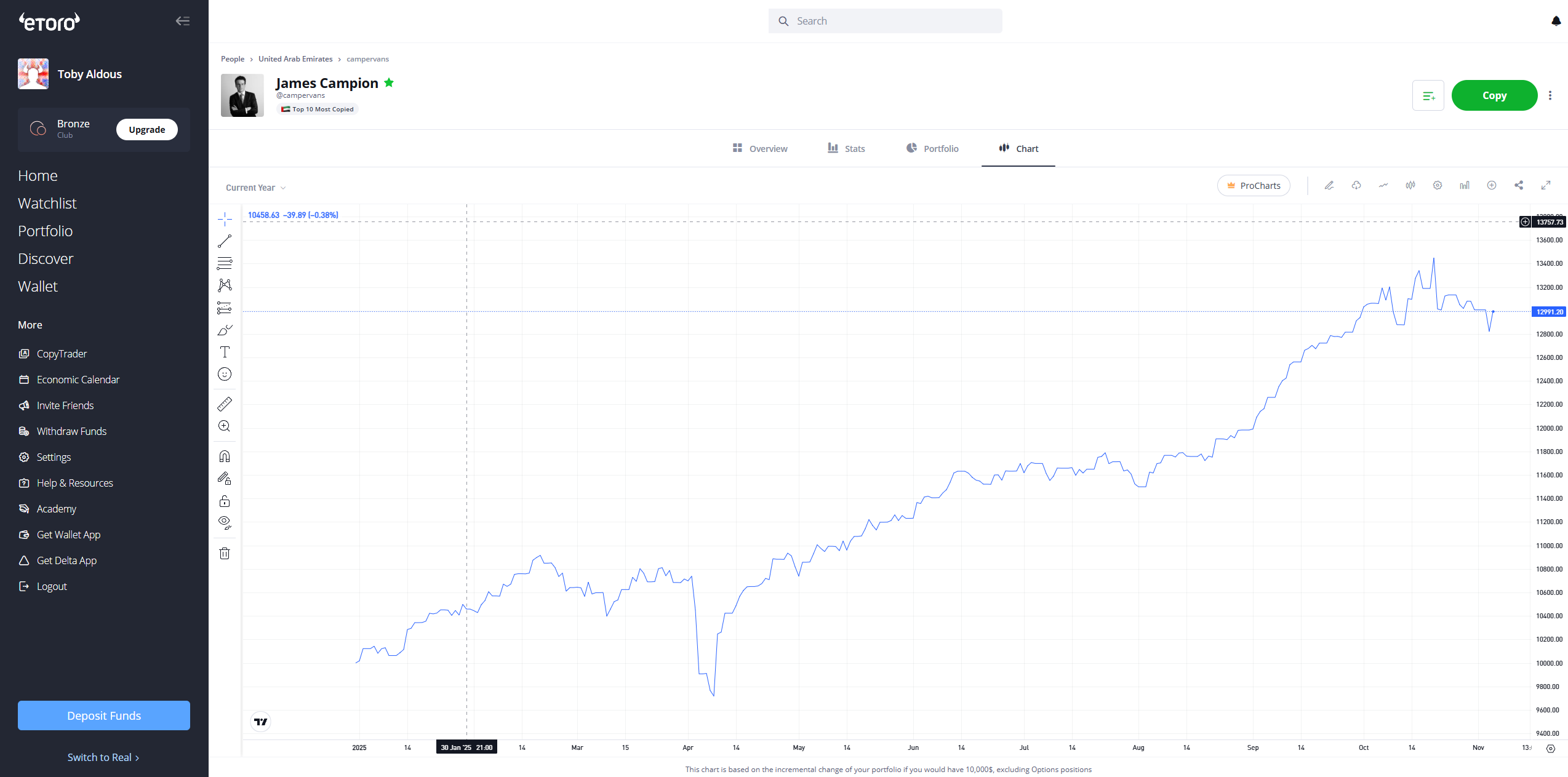

2. eToro – For CFDs & Social Trading

eToro combines CFD trading with social investing tools, allowing users to view, follow, and automatically copy the positions of other traders. The platform is FCA-regulated in the UK and registered to offer cryptoasset services.

The platform focuses on accessibility rather than complexity. You can trade CFDs across global markets, invest in real shares, or follow pre-built portfolios that track sectors and themes. The social feed and performance statistics make it easier for beginners to understand how different strategies work before risking real money.

Key Features

- CFDs and real investing in one FCA-regulated account

- Copy and mirror top traders through social trading tools

- Markets include stocks, indices, FX, commodities, and crypto (availability subject to regulations)

- Pre-built portfolios for long-term investing themes

- Free demo account with virtual funds

- Transparent spreads and portfolio-level risk management

| UK Regulation | Financial Conduct Authority (FCA) – United Kingdom |

| Products | CFDs, real shares, ETFs, and crypto assets (no crypto CFDs for UK retail clients) |

| Market Range | Stocks, indices, FX, commodities, crypto |

| Typical Leverage | Up to 1:30 (retail limits) |

| Demo / Practice | Yes (virtual account) |

| Tax Snapshot (UK) | CFD profits/losses typically fall under CGT |

| Website | eToro.com → |

Verdict: A regulated, user-friendly CFD platform with unique social trading tools that help beginners learn and copy strategies safely.

3. Plus500 – For FX & Indices CFDs

Plus500 is a long-standing CFD provider known for its clean interface, quick execution, and focus on simplicity. The platform is fully regulated by the FCA for UK users and offers access to a wide range of markets through straightforward order tickets and margin controls.

It appeals to traders who prefer a no-nonsense approach — no social feed, no unnecessary add-ons, just reliable tools for monitoring, opening, and closing positions efficiently. A free demo account allows you to test the interface before trading live, while real-time alerts and portfolio summaries keep you informed across devices.

Key Features

- CFD trading in FX, indices, share CFDs, commodity CFDs, and crypto asset CFDs (availability subject to regulations)

- FCA-regulated with negative balance protection

- Simple, intuitive interface designed for fast execution

- Custom price alerts and stop/limit order controls

- Free demo account with full platform functionality

- Clear breakdown of spreads and overnight funding costs

| UK Regulation | Plus500UK Ltd authorised & regulated by the FCA (FRN 509909). |

| Products | CFDs in FX, indices, shares, commodities, and crypto (availability subject to regulations) |

| Market Range | Major and minor FX pairs, global indices, and top equities |

| Typical Leverage | Up to 1:30 (retail limits) |

| Demo / Practice | Yes |

| Tax Snapshot (UK) | CFD profits/losses typically fall under CGT |

| Website | Plus500.com → |

Verdict: A reliable, FCA-regulated CFD platform with a clean interface and quick execution — ideal for traders who value simplicity and control.

How We Rank Financial Betting Platforms

Choosing a platform for leveraged trading isn’t just about tight spreads or flashy apps. Our ratings focus on safety, clarity, and how each provider performs in real-world use — not on short-term incentives.

- Regulation & Company Clarity – FCA permissions, segregated funds, transparent ownership and contact details.

- Product Quality – Market range (indices, FX, shares, commodities), execution speed, platform stability, mobile experience.

- Costs – Typical spreads, overnight financing, conversion fees, and how clearly they’re disclosed.

- Risk Controls – Stops/limits, guaranteed stops (where offered), margin alerts, negative balance protection.

- Onboarding & Education – Demo/practice accounts, in-platform learning, appropriateness checks.

- Support & UX – Responsiveness, clarity of the interface, reliability under load.

Regulation & Tax (UK)

Financial betting is regulated by the Financial Conduct Authority (FCA) rather than the UK Gambling Commission. Before opening an account, it’s important to understand how the main products differ and how UK tax typically applies.

| Product | Description | Typical UK Tax | Regulator |

|---|---|---|---|

| Spread Betting | Stake-per-point speculation on market movements. Leveraged but you don’t own the underlying asset. | Profits generally CGT-free; losses not offsettable for CGT. | FCA (UK) |

| CFDs | Contracts on price differences (long or short). Leveraged exposure without ownership of the asset. | Usually subject to Capital Gains Tax (CGT) on profits/losses. | FCA (UK) |

| Rolling Spot FX | Short-term leveraged FX trades. Operates under the same rules as CFDs. | Same as CFD treatment (CGT applies). | FCA (UK) |

| Fixed-Odds Financials | Simple “up or down” bets on prices (e.g., end-of-month BTC or interest rate levels). | Treated as standard gambling winnings — tax-free in the UK. | UKGC (Bookmakers) |

- Compliance note: Always verify the exact entity on the FCA Register. FCA-authorised firms must segregate client funds, issue standardised risk warnings, and assess suitability before trading. Note: the FSCS does not protect against trading losses, only firm insolvency in eligible cases.

- Tax note: Tax treatment depends on personal circumstances and may change. Seek professional advice if unsure.

Understanding the Risks of Financial Betting

Leveraged products magnify both gains and losses. Even on FCA-regulated platforms, poor sizing or fast markets can lead to rapid drawdowns. Before trading live, make sure you understand how costs, margin and execution behave in real time.

- Leverage amplifies moves. A small price change can translate into a large P/L swing; one outsized position can dominate your account.

- Gap risk is real. Prices can jump through stops during news or illiquid periods, causing larger-than-planned losses.

- Financing & fees compound. Overnight funding, wide spreads at off-hours, and currency conversions quietly erode returns.

- Emotional & frequent trading hurts. Chasing losses or overtrading increases costs and variance, reducing survival odds.

- Correlation bites. Positions that look diversified can move together (e.g., risk-on/risk-off regimes), increasing drawdown depth.

- Most retail accounts lose money. Misuse of leverage and weak risk controls are the usual reasons; capital preservation should come first.

View financial betting as high-risk speculation, not income. Use demos to practise, size conservatively, and only commit funds you can afford to lose.

Financial Trading Safety Checklist

Even with reputable platforms, do your own checks and start small until you understand how positions behave in real time.

- Verify the entity & permissions. Confirm FCA regulation under the exact legal name you’re opening with.

- Use the demo first. Test orders, stops, overnight behaviour, and margin calls with paper funds.

- Know the full cost stack. Spreads, overnight financing, conversion fees, inactivity fees—understand each before trading.

- Define risk per trade. Pre-set stops; size positions so a loss is acceptable (e.g., 0.25–1% account risk).

- Protect the account. Enable 2FA, secure devices, and never reuse passwords or share API keys.

- Avoid over-leverage. Keep margin usage conservative; scale only after consistent execution on the demo.

- Withdraw periodically. Don’t leave large idle balances; reconcile statements and tax records as you go.

Full Comparison Table (2026)

The table below brings the top picks together so you can compare product coverage, regulator status, and typical use cases before choosing where to open a demo or account. All listed providers are FCA-authorised, offer segregated client funds, and provide demo access so you can test the platform before committing real capital.

| Rank | Platform | Primary Product | UK Regulator | Demo | Typical Use Case |

|---|---|---|---|---|---|

| 1 | Spreadex | Financial spread betting | FCA (UK) | Yes | Tax-efficient speculation with stake-per-point control |

| 2 | eToro | CFDs + social | FCA (UK) | Yes | Discover/copy strategies; diversify via CFDs & investing |

| 3 | Plus500 | CFDs (FX/indices focus) | FCA (UK) | Yes | Clean UI, alerts, straightforward CFD execution |

Fixed-Odds “Financials” at Bookies Explained

Some traditional bookmakers and exchanges offer fixed-odds financials — simple markets where you bet on an outcome, such as a month-end BTC price range or an interest-rate decision, rather than trade price movements.

These are settled like normal bets, with no leverage and limited market depth. They’re fine for casual predictions or small speculative punts, but they’re not a replacement for spread betting or CFDs if you want full trading functionality and control.

Whichever approach you prefer, focus on transparency and discipline: start small, use demos where available, and learn how each product behaves before committing real money.

Financial Betting FAQs

Still have questions about financial betting? The FAQs below cover common points about regulation, tax, and risk management.

Is financial spread betting the same as gambling?

No. In the UK it’s an FCA-regulated financial product, despite the stake-per-point mechanic. It’s separate from UKGC-regulated gambling.

Are CFDs or spread bets better for beginners?

Neither is “easy”. Spread betting is familiar to sports bettors; CFDs can be more granular. Start on a demo, learn position sizing, and keep leverage low.

Can I lose more than my deposit?

Yes—leverage can magnify losses. UK firms provide negative balance protection, but you should still size conservatively and pre-define exits.

Do I need KYC and suitability checks?

Yes. These are regulated accounts. Expect identity verification and an appropriateness assessment before live trading.

Are profits tax-free?

Spread-bet profits are generally CGT-free; CFD profits/losses typically fall under CGT. Personal circumstances vary—seek independent advice.

Can I hedge sports bets with financial bets?

It’s possible to run uncorrelated strategies, but treat them separately. Financial products carry leverage and financing costs that change the risk profile.

Do platforms offer guaranteed stops?

Some do on selected markets. They can cap downside more predictably but may come with wider spreads or fees—check each platform’s product list.

What’s the best way to start safely?

Open a demo, practise order placement and stop discipline, then transition with small stakes. Review costs and withdrawal processes before scaling.

- Beating The Closing Line (CLV) | The Key To Successful Sports Betting? - January 19, 2026

- Top 10 Live Score Apps | Best For Football Scores & Updates - January 19, 2026

- Paysafecard | Gambling Prepaid Credit Card | Pros & Cons, Betting Sites - January 19, 2026