I’ve always been cautious about following tipsters. While I do believe there are genuine and profitable tipster services out there — some of which I recommend on Punter2Pro — I wanted to run my own test. So I subscribed to a well-rated tipping service for a month to see how it performed in practice.

What I didn’t expect was to uncover one of the most misleading tactics used in the tipster world — a clever trick that distorts profit records and deceives subscribers.

This article isn’t about writing off all tipsters as scams. Rather, it’s about sharing what I discovered during this trial — and what you should watch out for when evaluating a tipping service.

What I Was Looking For

I had a clear set of expectations for the ideal tipster. I wanted a service that offered:

- A professional-looking, well-designed website

- A solid reputation and track record

- Verifiable proof of profits

- Positive customer feedback

- A logical, data-driven betting strategy

- No mention of “inside info” or dubious claims

- A focus on value betting rather than just tipping winners

- A genuine reason for selling tips instead of keeping them private

- A fair subscription fee

I later expanded on this in my guide on how to avoid bad tipsters. It’s a checklist worth using before you ever pay for tips.

To my surprise, I found a service that appeared to meet all of these criteria. On paper, it looked like a solid bet.

A Promising Start

I won’t name the service, but it launched in the mid-2000s. Here’s what stood out:

- Polished website with a member login area

- Free trial with access to historical racing data

- Claimed profit proof (albeit vague), marketed as an “investment opportunity”

- Affordable: just £40/month for the base package

It all looked very legit. The sparse but positive reviews even added to the sense of exclusivity. Plus, the site claimed its picks were “proofed” by the Racing Post, which added credibility.

What really mattered, though, was the strategy: value betting. And it looked promising. The site didn’t rely on strike rate — or use it as a smokescreen to suggest success through a high win percentage at short odds. Instead, it focused on pricing inefficiencies, which is the real indicator of long-term betting profitability.

The service claimed to use historical data and speed ratings to determine target odds — the odds at which bets became profitable. Bettors were encouraged to back selections at or above those odds. It was right up my alley.

The site answered all my key questions, such as:

1. Why trust the selections?

They claimed that 75–80% of picks shortened in price by race time — a sign of value. Even if that figure was exaggerated, 60% would be strong. It aligned with my experience beating the closing line.

2. Can I actually get the target odds?

Premium users got early access, while basic members still had a good chance of hitting the mark. This seemed fair.

3. Why sell tips at all?

They claimed to have been banned by bookmakers for winning too much — so selling tips was now more profitable. I could just about buy into that idea.

The pitch was strong. So I took the plunge.

What I Discovered

Despite my scepticism, I remained cautiously optimistic. Could this be a rare gem hiding in plain sight?

I was looking for either:

- Value bets that beat the SP

- Or odds that became underpriced due to too many followers — creating opportunities to Lay them on exchanges, ironically the opposite of what the service recommends

Initial Observations

I paid the £40 fee and dived in. Straight away, I noticed something odd: the “target odds” seemed way off. One selection had an exchange price of 17.0 — but the target odds were 4.0. It was far too generous to be true.

This trend continued. The target odds were nearly always much lower than actual prices. The markets had plenty of liquidity, so the prices weren’t questionable.

I held off betting and asked the company for historic data. To their credit, they sent over a full year’s worth of tips in spreadsheet form. I loaded them into Excel and got to work.

Digging Into The Data

The spreadsheet included some bizarre outliers — odds of 1000/1 with supposedly multiple winners. That set off alarm bells. I queried it, and the company confirmed that 1000 was a default value for “technical issues.” Fair enough — I removed those entries to clean the dataset.

Then I graphed the performance of betting every selection at its “target odds”.

Backing all tips at the “target odds” using an equal stake of £50.

Total ROI: -35.4%

Wow. I can safely say those target odds were not prices I’d ever bet at. The algorithm was clearly underpricing horses by a wide margin.

Then I noticed another figure in the dataset: “best odds.” Curious, I ran the same analysis using those instead.

Backing all tips at the “best odds” using an equal stake of £50.

Total ROI: +99.6%

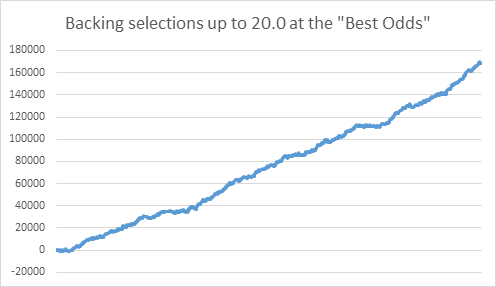

Looks amazing — but this kind of return is too good to be real. Something was off. The graph showed huge jumps in PnL. I filtered the data to include only odds up to 20.0 to remove unrealistic longshots and improve the integrity of the sample.

The reduced set came to 22,386 tips.

Backing all tips up to 20.0 at the “best odds” using an equal stake of £50.

Total ROI: +15.0%

That figure seemed more plausible. So I reached two key conclusions:

- Target odds were totally unrealistic.

- Best odds showed strong returns — but may be unachievable.

What Are “Best Odds”?

The company explained these were simply the best odds available before the race started. That’s a red flag — because there’s no way to consistently catch those prices. Bettors can’t possibly know the peak price ahead of time. If we could, we’d all be rich.

Still, I wanted to test it properly. So I followed the tips manually and entered roughly 500 “mock” bets into a spreadsheet — doing everything I could to hit the best available prices and see if a 15% ROI was even remotely achievable.

The Verdict

It didn’t make money. At best, it broke even.

Here’s why I gave up on this service:

- The best odds were impossible to consistently obtain.

- The P/L stats were misleading. They relied on peak odds that no user could expect to match.

- The average odds didn’t beat the SP. Over 500 mock bets, I averaged roughly the same as SP (around 1% above) — meaning there was no value.

Last Resort: Could I Lay at the “Target Odds”?

At this point, I wondered whether the service might actually be useful in reverse. If the “target odds” were so poor, could they be exploited from the opposite side of the market — by Laying instead of backing?

Unfortunately, no. Very few horses traded as low as the “target odds” at any point. So there wasn’t even a viable Lay strategy buried in the data. Shame.

What I Learned

This trial didn’t put me off all tipsters. In fact, it reminded me that some services are worth exploring — but only when they’re transparent, data-driven, and realistic about what’s achievable.

However, it did reveal how easily tipsters can inflate performance using a common sleight of hand: quoting ‘best odds’ that no one can realistically obtain. This creates the illusion of massive ROI — while subscribers often experience far less favourable outcomes in practice.

So the real takeaway is this:

- Always question how profit stats are calculated. If a service uses peak or theoretical prices instead of achievable odds, it’s highly misleading.

- Look for proof of beating the market. SP comparisons or live-recorded prices are far more useful than flashy profit claims.

- Good tipsters exist. But identifying them takes scepticism, data, and diligence — not hype.

If you want to find reputable, value-focused tipping services, I’ve reviewed several that I believe offer a realistic edge. Start with my guide to the Best Sports Betting Tipster Sites — and stay cautious out there.

- 10 Biggest Challenges For Betfair Traders | Problems To Overcome - February 11, 2026

- The Impact Of Weather On Horse Racing & Racecourses - February 10, 2026

- January 2026|Top Football Tipsters Of The Month - February 10, 2026