One key concept in sports trading is the Weight of Money (WoM), which refers to the balance in the amount of money being traded on a particular market.

The Weight of Money (WoM) is represented by a percentage value and shows when the market is “balanced” or “unbalanced”. It’s used by sports traders to predict the direction odds are likely to go.

Understanding WoM is essential for successful sports trading as it can provide valuable insights into market sentiment and help traders make more informed predictions.

What Is The Weight Of Money (WoM)?

At its core, WoM is a measure of the supply and demand for a particular market.

The market is said to be “balanced” when the amount of unmatched money on each side of a selection is the same. This means that the amount requested in Back bets must be approximately equal to that requested in Lay bets. On the other hand, the market is said to be “unbalanced ” when the amount of unmatched money on one side is disproportionate to the other.

Unbalanced markets are significant because they can result in the odds changing. The principle is as follows:

- When there’s more unmatched money waiting to be backed (i.e. requests from Layers), than the odds are likely to increase. The Weight of Money pushes the odds up.

- When there’s more unmatched money waiting to be layed (i.e. requests from Backers), then the odds are likely to decrease. The Weight of Money pushes the odds up.

The key to successful trading on the exchange is to anticipate market movements before they occur; hence why an unbalanced market is of importance to professional traders on Betfair and other betting exchanges.

How To Calculate The Weight of Money

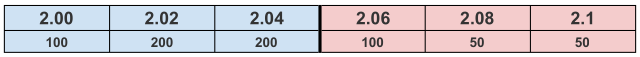

The Weight of Money is expressed as a percentage value based on the three best Back and Lay prices for a selection. In order to calculate it, let’s consider the following example:

In this situation we can see:

- The Back side has a total of 100 + 200 + 200 = 500 in available money, as requested from Layers.

- The Lay side has a total of 100 + 50 + 50 = 200 in available money, as requested from Backers.

Therefore the market is unbalanced with a ratio of 500:200, showing significantly more unmatched money waiting to be backed than unmatched money waiting to be Layed. This alone tells you what you need to know about the WoM, but you can also calculate it as follows:

WoM = Money on Best Three Lay Prices / (Money on Best Three Lay Prices + Money on Best Three Back Prices)

- Where the WoM is less than 50%, the amount from unmatched Lay bets is greater than the amount in unmatched Back bets.

- Where the WoM is greater than 50%, the amount in unmatched Back bets is greater than the amount in unmatched Lay bets.

In this example the calculation is: 200 / 700 = 0.2857 = 28.57%, representing the disproportionate amount of money that’s unmatched from Lay bets compared to Back bets.

This case represents a high volume of Lay requests (bets against this outcome), which suggests that traders saw value in taking a pessimistic view of this outcome. However, if those bets remain unmatched traders may be forced to improve (raise) their offer in order to attract more bets from backers. Hence, the odds are likely to increase.

In the opposite scenario, when the Lay side has significantly more unmatched money than the Back side, it suggests that traders saw value in taking an optimistic view of the outcome. However, if those bets remain unmatched, Backers may have to reduce their requested prices in order to attract more bets from Layers. Hence, the odds are likely to decrease.

How Can Weight Of Money Be Used?

In any market, there will be a mix of casual bettors and professional traders. The casual bettors are typically less informed and less skilled than the professionals, and are likely to place smaller stakes. The professionals, on the other hand, will have access to more data and will have a better understanding of the market. As a result, they are more likely to place larger bets, and influence the WoM more heavily.

Therefore by tracking WoM, traders can identify where the smart money is going and use this information to inform their own trades. For example, if the WoM is high on a particular market, this could indicate that professional traders are confident on one side of an outcome. Traders may therefore look to follow the money.

Another way that sports traders can use WoM is to identify when the market is about to move. If the WoM is increasing rapidly, this could indicate that the market is about to shift, and traders may need to act quickly to take advantage of the change.

Ultimately, the weight of money is an essential concept for any sports trader to understand. By tracking WoM, traders can gain valuable insights into market sentiment, identify where the smart money is going, and make more informed trading decisions.

Weaknesses In Using Weight Of Money

WoM is just one of many factors that traders to consider when trading sports markets in order to gain a competitive edge and increase their chances of success. Using WoM alone is unlikely to yield positive results because it is so susceptible to noise and price manipulation. This is particularly true when there’s insufficient liquidity.

For instance, suppose one trader entered the market for the above example and requested a back bet of £1,000 at odds of 2.1. Suddenly the balance is shifted in the opposite direction with a ratio of 500:1200. This could be completely meaningless bet, rather than a signal of intelligence. Therefore traders have to be cautious not to act on WoM in every situation.

Here are some tips to consider when using WoM to forecast the market:

- Check for sufficient liquidity: In illiquid markets, WoM is highly sensitive. Ensure there is enough liquidity before making any moves.

- Incorporate sanity checks: It’s imperative to include sanity checks into your betting model if WoM heavily influences your actions. This will prevent you from making misinformed decisions.

- Be vigilant of market manipulation: Market manipulation, like in finance, is another risk. Be aware of large orders that create a misrepresentation of supply and demand to provoke movements in price. Vigilance is key when basing price predictions on WoM.

- Don’t rely solely on WoM: there are strategies that seek to profit from naïve traders who rely solely on WoM. Be aware of bots that intentionally force movement in odds.

- Monitor the total money matched: A more encompassing method to gauge the flow of money is to monitor total money matched on Back and Lay selections and their previously traded odds. This will help interpret the value of the current odds and appreciate the significance of WoM relative to the trading day as a whole.

- Be aware of your own stakes: Your own stakes can influence the market, too. Queueing a relatively large stake in an illiquid market can create an imbalance in WoM, which can work against you. To avoid creating an imbalance, consider averaging-in your desired odds with a total stake split up into multiple, smaller bets. This will help to avoid being unmatched at higher odds.

In summary, using WoM in betting requires a thorough understanding of market liquidity, sanity checks, vigilance against manipulation, and avoidance of naïve strategies. By monitoring total money matched and being aware of your own stakes, you can make informed decisions that will help you successfully use WoM as a forecasting tool.

In order to better monitor the WoM you’ll want to use a professional trading tool. I recommend the following:

- Decimal Odds | What Are Decimal Odds? How Do They Work? - July 7, 2025

- June 2025|Top Football Tipsters Of The Month - July 7, 2025

- June 2025 | Top Horse Racing Tipsters Of The Month - July 7, 2025