Scalping is a technique used by sports traders to profit from small price movements on the betting exchange.

In this article I explore what scalping is, how it works, and whether it can be an effective betting strategy. I also offer tips on how to get started.

Article Contents

What Is Scalping?

Scalping on a betting exchange refers to a strategy where a bettor aims to profit from small, rapid odds fluctuations. It involves placing both a back bet (betting on an outcome to happen) and a lay bet (betting on an outcome not to happen) on the same selection, locking in a gain regardless of the event’s result.

The idea is to exploit inefficiencies before the market corrects itself. Individual profits are tiny, but frequent trades add up.

Scalping is popular with experienced traders because it generates returns without relying on a single outcome. But it demands deep market knowledge and lightning-quick reactions, so novice bettors can struggle.

Pros & Cons of Scalping

Scalping, like any strategy, has upsides and drawbacks:

Pros

- Low risk – profits are taken in tiny increments rather than via big swings.

- Consistent income – you can bank a drip-feed of gains before or even during an event.

- Flexibility – any volatile market is a potential playground.

- Control – you adjust positions on the fly rather than sweating a final whistle.

- Automation – rules can be coded into trading software to scalp hands-free.

- Scalability – dozens of events each day let a profitable method snowball.

Cons

- Time-consuming – constant screen-watching and rapid clicks are required.

- Low returns per trade – many cuts make the cake; one slice won’t.

- Commission – frequent wins mean frequent exchange fees.

- Execution risk – odds can run away before your hedge fires.

- Software costs – subscription tools are almost mandatory.

- Premium Charge – long-term winners on Betfair may face the Premium Charge.

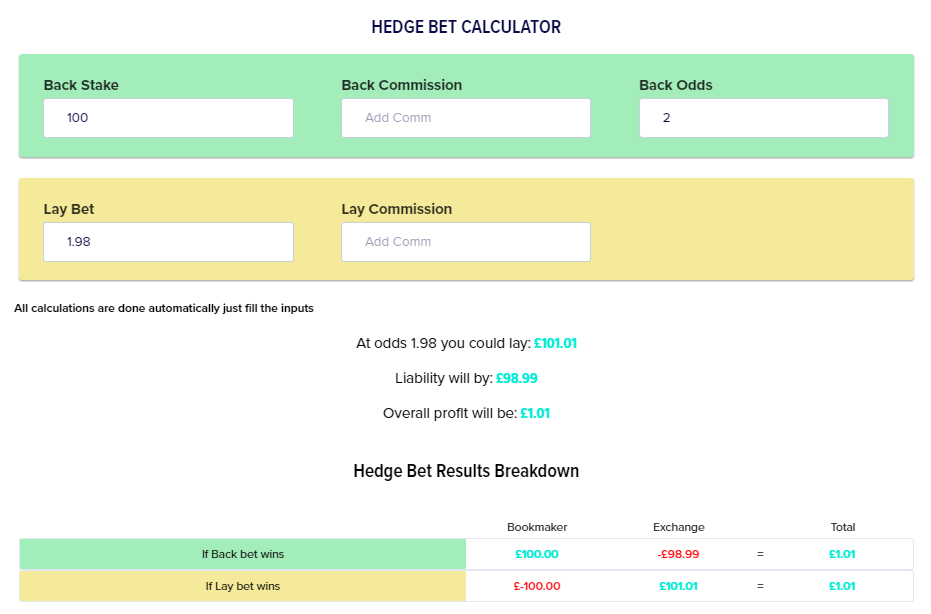

Scalping Example

Scalping is an “in-and-out” tactic. Traders are cold to team news and simply hunt one- or two-tick moves.

Suppose you request a £100 back on Spurs at 2.00 and simultaneously lay £100 at 1.80.

If both bets match (commission ignored):

Spurs Win

- Back: £100 × 2.00 = £200 return

- Lay: –£198 liability

Net = +£2

Spurs Don’t Win

- Back: –£100 stake lost

- Lay: +£100 stake won

Net = £0

Software lets you “green up”, spreading that £2 evenly across all outcomes:

This assumes both orders fill. If news breaks (e.g. an injury) one side could match while the market runs away, leaving exposure you must manage.

When Do Scalpers Enter the Betting Market?

Scalpers chase volatility. News such as a non-runner announcement (see voided bets) or a tipster shout can jolt prices, so traders jump in before rivals pile on.

Act early to secure a profit before the market settles — but remember volatility cuts both ways, so be ready to scratch out if the price moves the wrong direction.

Tips for Successful Scalping

- Use a low-commission exchange – every tick counts. Compare exchanges.

- Stick to your rules – discipline beats hunches.

- Be patient – edge emerges over hundreds of trades, not ten.

- Leverage software – trading tools detect opportunities and fire orders faster than manual clicking.

- Start small – test with tiny stakes until execution is second-nature.

- Target liquid markets – UK horse racing in the last 20 minutes pre-off is ideal.

- Watch tick sizes – steps widen above 2.00, so risk grows.

- Follow market news – sudden info spikes = price spikes.

- Keep a log – analyse results and refine.

- Learn from errors – losses are lessons if you review them.

- Control emotions – fear and greed kill edge.

- Use stop-losses – protect the bank when a trade runs away.

Don’t Believe Every Success Story

Plenty of sites sell scalping courses. Ask yourself: if a method prints money, why sell it?

See my article: Can sports-betting courses be trusted?

One course I do recommend is Mike Cruickshank’s “Betfair 1 % Club”, part of the Betting Mastermind bundle — a collection of tools and strategies that justify the up-front fee.

Learn more about Betting Mastermind

Is Scalping Worth the Effort?

Success depends on skill, experience, risk appetite and market conditions. Pros who consistently spot mis-priced ticks can grind out steady profits, but many novices find results mixed.

The approach is time-intensive and stressful. It is not a get-rich-quick scheme; automation and rigorous execution are vital. Enter with realistic expectations and a willingness to learn.

- LeoVegas Review | Is The Sportsbook Worth Using? [2025] - July 2, 2025

- Hollywoodbets Review | Is It An Underrated Bookie? [2025] - July 2, 2025

- NetBet Review | A Reliable, Trustworthy Online Bookmaker? [2025] - July 2, 2025

My question is:

How many scalpings can you do on a day?

There’s frequent opportunities to scalp – but it’s not an approach that I’d highly recommend. It’s competitive, and other bettors are doing it so quickly and effectively that the majority of people won’t be able to consistently profit. If you attempt it, be cautious and build up slowly.

Thousands are possible given the right market conditions.